Are you prepared for 2025’s fashion industry trends? As we approach 2025, the fashion industry is poised to experience tremendous upheavals that will reshape how we purchase, produce, and consume apparel.

From the growth of artificial intelligence (AI) to a greater dedication to sustainability, these trends are more than simply fleeting fads; they are defining the future of fashion. If you want to stay ahead of the curve and relevant in this rapidly changing business, it’s time to catch up on the important trends that will dominate the fashion scene in 2025.

Highlights:

- The four main trends shaping fashion in 2025 include digital innovation, ESG & the circular economy, online and offline integration, and social commerce.

- For fashion retailers, these trends demand a POS system that supports omnichannel capabilities, real-time inventory tracking, and integration with digital payment and sustainability tools.

8 Must-Know Fashion Industry Trends for 2025

Digital Innovation

As digital adoption accelerates, apparel retailers are being pushed to innovate and adopt emerging technologies. During the pandemic, the focus was on rapidly expanding online capacity to bridge the gap between physical and digital channels.

Retailers directed investments into advanced digital marketing campaigns, automated fulfillment systems, and innovative shopping tools, such as livestreaming and customer service video chat. In many cases, this rapid shift condensed transformation plans that would have taken years into just a few months.

Moving forward, retailers need to further strengthen their digital capabilities. Shoppers now expect elevated and engaging digital experiences, prompting apparel brands to explore new ways to attract and retain customers. Some effective approaches include implementing augmented reality (AR) that are fashion industry trends to enrich online shopping and developing next-generation mobile applications that check stock availability and enable self-checkout.

Flexible payment solutions are becoming increasingly important in fashion ecommerce, as customers’ preferences and financial needs continue to evolve. Offering a variety of payment options not only drives sales but also enhances the overall shopping experience.

Flexible payment solutions in fashion ecommerce

Buy Now, Pay Later (BNPL) services have become increasingly popular as fashion industry trends, allowing consumers to shop now and pay later, often without interest. Services like Afterpay, Klarna, and Affirm have played a significant role in making fashion more accessible and reducing cart abandonment. For example, Frasers Group has integrated its Frasers Plus BNPL service into THG’s Ingenuity ecommerce platform, emphasizing the growing role of flexible payment options.

Traditional credit cards continue to be a major payment method in fashion ecommerce due to their convenience and flexibility. Many customers prefer using credit cards to earn rewards, take advantage of cashback offers, or simply make payments over time. Secure payment gateways ensure that these transactions are smooth and safe.

Mobile wallets such as Apple Pay, Google Pay, and PayPal are gaining popularity due to their ease of use and security. They provide a contactless checkout experience that has become more desirable, particularly in recent years. In markets like China, mobile wallets dominate, and other regions, like India and Indonesia, are seeing significant adoption as well.

Some fashion brands are now offering installment payment plans, allowing customers to split their purchases into smaller payments. This makes premium fashion items more accessible, broadening their appeal to a wider audience.

ESG & the Circular Economy

Environmental, Social, and Governance (ESG) initiatives are becoming central and fashion industry trends to the strategies of apparel retailers as sustainability takes center stage. Consumers are increasingly favoring brands that prioritize responsible practices, pushing companies to rethink production models and reduce environmental impact. The circular economy, which focuses on reducing waste and extending the lifecycle of products, offers a tangible path forward.

Apparel brands are adopting circular practices by introducing initiatives such as garment recycling programs, resale platforms, and rental services. These approaches minimize waste, lower resource consumption, and provide new revenue streams while aligning with evolving consumer expectations for sustainability. Additionally, advancements in sustainable materials, such as recycled textiles and biodegradable fabrics, are helping businesses meet environmental targets without compromising on product quality.

Embedding ESG principles into operations not only addresses environmental challenges but also fosters stronger relationships with stakeholders. By embracing circularity and responsible innovation, apparel retailers can position themselves as industry leaders while contributing to a more sustainable future.

Membership Programs

Membership programs are rapidly gaining traction in the fashion industry as fashion industry trends to build stronger connections with shoppers. Today’s consumers seek meaningful engagement and enjoy feeling part of an exclusive group that shares a connection to their favorite brands.

This sense of belonging is strengthened through personalized perks, with shoppers ranking exclusive benefits (32%) and tailored offers (28%) among the most appealing program features.

The athleisure brand Fabletics stands out as a leader in this space. Its flexible VIP membership provides customers access to discounted collections, appealing to price-conscious yet loyal shoppers. Similarly, H&M has created a rewarding experience through its membership initiative, which includes free shipping, in-store recycling programs that exchange old clothes for vouchers, and exclusive discounts.

Programs can take various forms depending on the brand’s goals. Some businesses opt for a subscription-based model, while others build loyalty through free memberships. Regardless of approach, membership programs help cultivate long-term relationships with customers by rewarding their ongoing engagement.

Next-Level Gamification

Gamification, which adds fun and interactive elements to online platforms, is a fashion industry trend that is now a key strategy for brands looking to keep customers engaged. Whether on an app, website, or social media, gamification encourages consumers to spend more time interacting with a brand’s digital content.

Chinese e-retailer Temu exemplifies this approach through its hyper-personalized scrolling feed, which draws shoppers in with tailored suggestions and continuous content discovery. Brands can implement similar tools to drive engagement, such as interactive advertising or content prompts that encourage audiences to comment, share, and interact with posts.

These tactics increase visibility, foster brand loyalty, and influence purchasing decisions by creating an enjoyable experience that feels organic and engaging.

Online and Offline Integration

The decline of physical stores gave rise to stronger online investments across the retail sector. Despite this shift, in-person shopping has remained popular, as consumers increasingly value the chance to interact with products directly. Stores allow shoppers to take a break from digital screens while still connecting to a brand’s ecosystem.

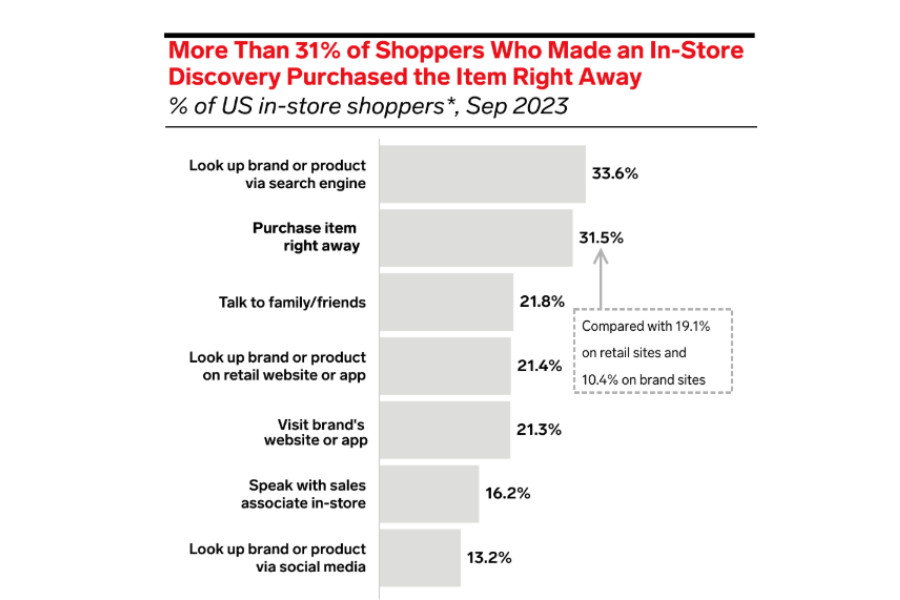

The interplay between physical and digital experiences is reshaping retail. Many shoppers research products online before purchasing them in-store, and a significant portion – 31% are ready to buy immediately after seeing an item firsthand. This reinforces the need for a connected omnichannel strategy where online and offline operations complement one another.

Retailers are adopting practices such as Click & Reserve and Click & Collect to merge both experiences, giving customers more convenience and flexibility. Other methods, like offering in-store returns for online purchases or fulfilling deliveries from physical store locations, bridge the gap further and create a unified shopping journey that meets consumer expectations.

Artificial Intelligence

2024 marked a turning point for artificial intelligence (AI), as its advancements captured both public attention and industry focus. In fashion, AI has become deeply embedded in operations, influencing everything from design processes to customer experiences and supply chain management.

AI’s presence extended to global fashion events. It continued as fashion industry trends in 2025, with Naomi Campbell showcasing the Humane AI Pin at Paris Fashion Week and Collina Strada introducing AI-driven reinterpretations of its brand in New York. Beyond the runway, AI is proving its value by driving personalization strategies, improving decision-making, and addressing key industry challenges.

McKinsey projects AI will contribute between 150 and 275 billion USD to fashion industry profits over the next few years, a clear indicator of its growing role. Fashion leaders are also looking to AI for solutions in sustainability, inclusivity, and creative innovation, providing new opportunities to meet evolving demands.

Social Commerce

Social commerce solutions are fashion industry trends that have transformed how consumers shop by enabling purchases directly through social media platforms. While live shopping has been a staple in Asia for years, particularly in China, its influence is spreading. Projections estimated that China’s live shopping streams would generate up to 720 billion USD in revenue for 2023, with final figures yet to confirm this milestone.

Western markets are gradually catching up as platforms like Instagram and TikTok expand their commerce features. For younger generations, Instagram has become a digital storefront, while TikTok’s launch of live shopping mirrors the success of its China-based counterpart, Douyin. Douyin has sold over ten billion products, and TikTok Shop’s potential to follow suit opens new opportunities for brands targeting millennial and Gen Z audiences.

Live commerce alone could account for up to 20% of global e-commerce sales by 2026. Brands that begin developing social commerce strategies now will be well-positioned to capitalize on this rising trend.

How ConnectPOS Supports Your Store to Stay Ahead in the Changing Fashion Industry

ConnectPOS provides practical tools to help fashion businesses adapt to emerging fashion industry trends like omnichannel retail, personalization, gamification, and social commerce.

- Unified Online and Offline Experiences: ConnectPOS provides omnichannel POS that synchronizes in-store and online operations in real time. Customers can browse products online, check availability, and choose how to complete their purchase – whether in-store or through pickup services like Click & Collect. This integration makes shopping experiences more consistent and convenient.

- Data-Driven Personalization: ConnectPOS allows fashion retailers to analyze customer preferences and purchasing behaviors. This insight helps tailor offers, recommend products, and design loyalty programs that resonate with shoppers. Personal touches like exclusive discounts for members create stronger customer relationships and encourage repeat purchases.

- Tools for Engagement: Retailers can use ConnectPOS alongside interactive tools to create engaging shopping experiences. From loyalty rewards to interactive promotions, businesses can design activities that keep customers entertained and involved, increasing online engagement and driving store visits.

- Social Commerce Integration: ConnectPOS connects with various platforms like Shopify and WooCommerce, enabling sales directly through Instagram, Facebook, and TikTok. This approach helps fashion brands tap into younger shoppers and meet growing demand for live shopping opportunities.

- Smarter Inventory Management: Through real-time updates, ConnectPOS keeps inventory accurate across channels, preventing stockouts and overstocking. By analyzing trends, businesses can anticipate demand, streamline supply chains, and ensure product availability.

FAQs: Fashion Industry Trends

1. How are fashion retailers staying competitive amid these fashion industry trends?

Fashion retailers are adopting technology like AI, integrating social commerce, refining omnichannel strategies, and using data to personalize experiences. These tools help brands stay relevant and meet changing consumer expectations.

2. Why is resale fashion growing?

Resale thrives due to affordability and sustainability. Platforms like Depop and Poshmark attract eco-conscious shoppers, while luxury brands embrace authenticated secondhand markets.

3. What is social commerce and how is it changing fashion retail?

Social commerce allows consumers to buy products directly from social media platforms. In 2025, this trend will continue to grow, especially through live shopping events on platforms like Instagram and TikTok.

Conclusion

The fashion industry in 2025 presents a world of new opportunities, driven by digital advancements and sustainability fashion industry trends. Staying ahead in this competitive, tech-focused market is vital for long-term success. Make sure you don’t fall behind—take steps today to adapt and stay ahead of the changes reshaping the fashion world.

Start with ConnectPOS to simplify your processes and build a solid foundation for your fashion business. The future is here – act now to shape it.