A POS system is a key component of store operations, and without a reliable offline mode, disruptions can lead to unnecessary losses. A cloud-based POS with offline functionality combines modern convenience with the dependability of traditional systems, keeping transactions smooth even during internet outages. Further than that, this type of system brings a range of benefits. It helps retailers handle orders faster, keep financial records accurate, and maintain customer satisfaction without delays. This article explains “how does offline POS work” and how it supports both daily operations and long-term business success.

Highlights:

- An offline POS records transactions, securely stores payment details, and syncs data once the internet connection is restored, so sales continue without disruption.

- POS offline mode is essential during internet outages, weak WiFi signals, or temporary sales events like pop-up shops and trade shows where connectivity is unreliable.

How Does Offline POS Work?

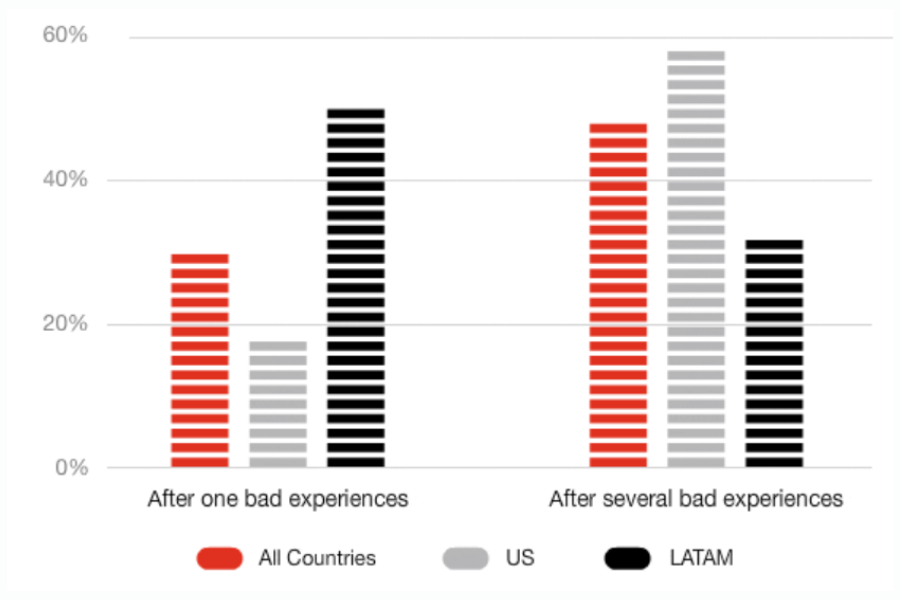

A single payment failure due to internet downtime can drive customers away for good. Studies show that 32% of customers would abandon a brand they love after just one bad experience, and in Latin America, this jumps to 49%. Even in the U.S., 17% of consumers won’t give a second chance after a failed interaction.

If your POS lacks offline mode, every internet outage puts your business at risk of lost sales and damaged customer loyalty. A cloud-based POS with offline functionality prevents these disruptions, making sure payments go through smoothly, regardless of connection status.

So, how does offline POS work in real-world scenarios? Let’s break it down.

Capabilities of Your POS in Offline Mode

Even without an internet connection, sales can continue without disruption. Staff can process purchases, scan barcodes, and finalize transactions, keeping business operations smooth.

Customers can pay with cash or card, ensuring that transactions are not delayed due to connectivity issues. A POS with offline mode records payments securely and syncs them once the connection is restored.

Receipts remain available, whether printed or sent digitally. Shoppers can walk away with proof of purchase without waiting for the system to reconnect.

Inventory updates stay accurate as sales are logged offline and automatically adjusted when the system reconnects. This prevents stock discrepancies and keeps product counts reliable.

How Offline Credit Card Processing Works

A POS without offline capabilities can bring transactions to a halt when the internet drops. In such cases, card payments become unavailable, leaving only cash as an option. This can lead to lost sales as many shoppers rely solely on cards.

A POS with offline mode prevents this issue by securely storing card transactions on the payment device. Once the connection is restored, the system sends transactions to the bank for approval.

With a cloud-based POS, this POS handles offline payments more effectively when the payment processor is fully integrated since both operate on the same system. If the payment processor is separate and unconnected, offline payments may not be possible, even if the POS supports them. To avoid disruptions, choose a payment processor that integrates with your POS, supports offline mode, and processes card payments without an internet connection.

Limitations of Offline Mode

Inventory updates may not be accurate while transactions are processed without an internet connection. Stock levels remain unchanged until the system reconnects, which can lead to overselling if items sell out during the outage.

In addition, card payments processed offline carry a risk of declined transactions. Since authorization happens later, a customer’s card may not have enough funds when the system attempts to process the payment. This can result in losses for the business.

Certain POS functions may be unavailable until the connection is restored. Loyalty programs, discounts, and real-time reports often rely on cloud access, limiting what staff can do while offline.

Also, security risks increase when transactions are stored instead of verified instantly. Without an immediate connection to banks or payment processors, fraud detection tools may not work, making it harder to prevent unauthorized purchases.

When to Use Your POS Without Internet

When does offline mode become necessary? Several situations require a POS to function without an internet connection.

- Short Internet Disruptions: Losing connection due to service issues or bad weather can bring transactions to a standstill. A POS that automatically switches to offline mode keeps payments running until the internet is stable again.

- Weak WiFi Signal: A POS may struggle to stay connected in areas with poor signal strength. Thick walls, large spaces, or outdoor service areas can cause interruptions. Businesses operating in food trucks, open-air markets, or large venues often face this challenge. Offline mode keeps sales moving even when the connection is unreliable.

- Temporary Sales Locations: Events, pop-up shops, and catering setups often lack WiFi access. In the past, handling sales in these situations meant relying on cash and manual record-keeping. A POS with offline mode makes it possible to accept card payments and process orders without interruption.

Advantages of a POS with Offline Functionality

A POS system with offline mode keeps your store running smoothly, even when the internet is down.

- Sales Keep Flowing: A system that processes offline credit card transactions prevents revenue loss during outages. Since digital payments dominate sales in many regions, relying solely on cash can turn customers away.

- Customers Stay Satisfied: Unstable connections disrupt service, especially in restaurants where orders are sent to kitchen display systems (KDS). When systems fail, staff must rely on handwritten tickets, increasing errors and slowing service. A POS with offline mode keeps communication between front and back-of-house intact.

- Data Remains Intact: POS systems that don’t store transactions during an outage create gaps in reporting. A system that logs sales and syncs them later keeps financial records accurate.

Why Use ConnectPOS?

ConnectPOS provides an offline mode that keeps transactions moving even when the internet is down. This feature is especially useful for businesses that depend on uninterrupted sales, such as retail stores and restaurants.

Key Benefits of ConnectPOS Offline Mode:

- Uninterrupted Sales – Process transactions smoothly without an internet connection, preventing lost revenue during outages.

- Offline Payment Processing – Accept payments offline and sync them once the connection is restored.

- Data Syncing – Sales data is securely stored and automatically updates when back online, maintaining accurate records.

- Consistent Operations – Ensure order management, receipts, and inventory tracking remain functional, avoiding disruptions in service.

With offline mode, ConnectPOS keeps your business running without interruptions, ensuring customers receive a smooth shopping experience.

Of course, that’s not the only thing this powerful POS can do. ConnectPOS includes a wide range of features designed to support modern retail operations:

- Real-Time Synchronization – Keeps inventory, orders, and customer data updated instantly across all sales channels.

- Multi-Store & Multi-Warehouse Management – Centralized control for businesses managing multiple locations and warehouses.

- Diverse Payment Options – Supports cash, credit/debit cards, QR payments, mobile wallets, Buy Now Pay Later (BNPL), and split payments.

- Customizable POS Interface – Businesses can modify the POS layout, add custom fields, and create personalized workflows.

- Advanced Reporting & Analytics – Provides real-time insights into sales trends, inventory movement, and customer behavior.

- Loyalty Programs & Promotions – Enables membership tiers, discounts, and reward systems to encourage repeat purchases.

FAQs: How Does Offline POS Work

Can transactions still be processed without the internet?

Yes, sales continue even when the connection drops. The system records transactions and syncs them once online again.

How are payments handled in offline mode?

Card payments can still be accepted, and details are securely stored. When the connection is restored, pending transactions are processed.

Does offline mode affect inventory tracking?

No, stock levels update once the system reconnects, keeping records accurate.

Is data lost during an outage?

No, sales, payments, and order details are saved locally and sync automatically when online.

Conclusion

Looking for a new POS system or reconsidering your current setup? Understanding how does offline POS work is key to maintaining seamless operations. A cloud-based POS with offline mode provides flexibility and reliability. Traditional systems keep data locked in a single location, limiting remote access. A cloud-based POS with offline functionality keeps transactions running smoothly, preventing business disruptions.

ConnectPOS is a cloud-based POS that keeps operations running smoothly, even offline. It supports real-time sync, various payment methods, and remote access to sales data. Get started with ConnectPOS today!

ConnectPOS is a all-in-one point of sale solution tailored to meet your eCommerce POS needs, streamline business operations, boost sales, and enhance customer experience in diverse industries. We offer custom POS with features, pricing, and plans to suit your unique business requirements.