In South Africa, businesses are increasingly turning to mobile Point of Sale (POS) systems to keep up with the demands of a fast-paced market. The ability to process payments on the go, manage inventory efficiently, and offer flexible customer experiences has made mobile POS South Africa solutions indispensable. However, with the growing number of options available, selecting the right system can be overwhelming. Businesses must consider various factors like compatibility with local payment methods, cost, scalability, and security to find a solution that suits their specific needs. This guide focuses on practical steps and considerations to help businesses in South Africa find the perfect mobile POS system.

Highlights:

- When selecting a mobile POS in South Africa, focus on compatibility with local payment methods, real-time inventory management, integration with existing systems, and adherence to regulatory standards like POPIA.

- Successful implementation involves setting clear goals, offering thorough staff training, testing the system through a pilot program, and monitoring performance to refine its functionality.

Key Considerations for Selecting a Mobile POS in South Africa

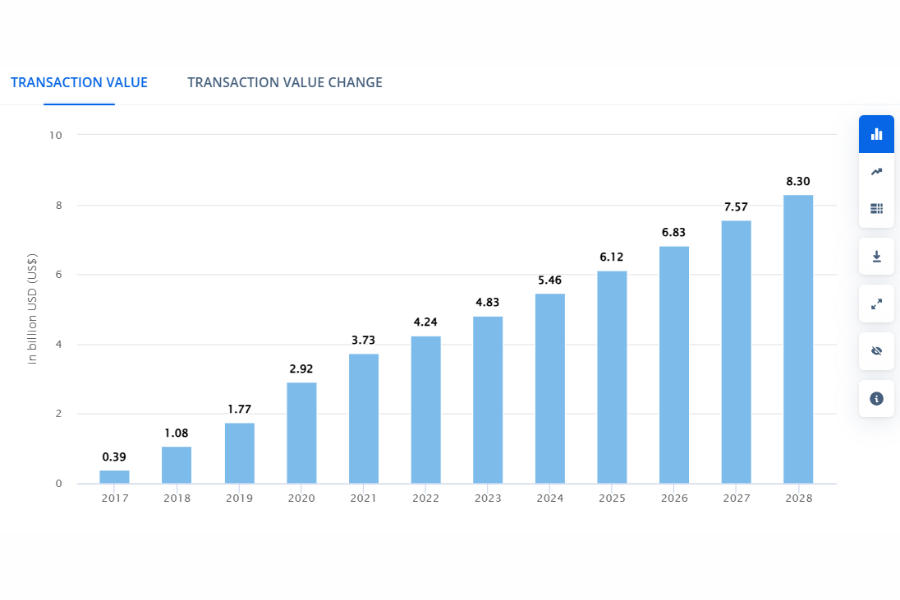

The mobile POS (Point of Sale) payments market in South Africa is witnessing significant growth, with transaction values projected to reach US$5.46bn in 2024. This growth highlights the importance of selecting a system that goes beyond basic functionality to support long-term business strategies.

A mobile POS South Africa requires careful consideration across several operational and regulatory areas. Each of these contributes to a solution that’s more than a transaction tool; it becomes central to a well-rounded and data-driven business strategy.

Here’s a comprehensive guide on what to focus on:

Tailoring to Business Needs

A clear understanding of your business’s unique needs forms the foundation of choosing a suitable mobile POS South Africa. Analyzing factors like the business type, daily transaction volume, and specific pain points helps in aligning the POS system with operational goals.

For example, a small café or boutique may benefit from simplicity in features, while larger businesses might need detailed inventory management, complex reporting, and analytics tools.

Integrating with Existing Systems

Compatibility with other business tools can greatly impact efficiency and accuracy. A mobile POS South Africa that works well with current applications like e-commerce, accounting, and CRM software promotes cohesive operations and ensures data consistency.

For example, integration with an inventory system allows immediate stock updates across all channels, providing reliable information for sales and restocking. Choosing a POS system that aligns with your tech setup allows smoother workflows and creates a foundation for future upgrades.

Adapting to South African Payment Preferences

A variety of payment options reflects the diverse South African market, where both traditional and digital methods are common.

Including support for mobile payments like SnapScan, and Zapper, and local e-wallets such as VodaPay and FNB’s eWallet makes transactions convenient and accessible. Such adaptability strengthens customer satisfaction and reduces abandoned purchases, especially as more people turn to mobile payments.

Real-Time Inventory Management

Effective inventory tracking helps businesses maintain stock levels that match customer demand, which is particularly important for retailers managing large inventories. Real-time updates prevent overstocking or stockouts, allowing businesses to quickly react to purchasing trends.

With inventory tracking at the moment, businesses can also make more accurate restocking decisions and avoid wastage, ultimately saving costs and improving supply chain relationships.

Evaluating Total Costs

Budget planning involves more than setup fees or monthly charges; transaction fees, hardware requirements, and future upgrade costs all contribute to the total investment. Considering long-term value is key—assessing whether a mobile POS South Africa brings enough benefits to offset its costs over time.

For instance, a system that enables faster transactions, better stock control, and improved data tracking can help reduce manual labor and improve customer experience, driving overall business value.

Customizing to Local Market Dynamics

South African consumer preferences vary, with some areas favoring mobile or digital payments and others preferring cash or cards. A POS that accommodates these habits, such as offering various language and currency options, creates a more intuitive experience.

Some POS systems also allow interface customization, which means you can adjust prompts, transaction processes, and even language based on the preferences of your customer base. Localized adjustments enhance brand appeal and customer loyalty.

Addressing Regulatory Requirements

Compliance with South African data and financial regulations builds trust and avoids potential legal issues. Standards like the Protection of Personal Information Act (POPIA) and financial transaction regulations set by the South African Reserve Bank establish strict guidelines.

Mobile POS systems with built-in encryption, secure storage, and robust reporting features help protect sensitive customer data and maintain trust.

Access to Support and Training

Transitioning to a new mobile POS South Africa can come with challenges, and access to reliable support and training resources can make a big difference.

A provider offering round-the-clock helpdesk services, online resources, or in-person training allows staff to adapt quickly and handle any technical issues that arise. Ongoing training also proves valuable for new hires and as business needs evolve, helping teams get the most from the system.

Best Practices for Implementing Mobile POS South Africa

Implementing a mobile POS South Africa system successfully in South Africa involves a practical approach to align the system with both business needs and local market preferences. By focusing on core steps and local nuances, a business can set up a POS system that effectively supports operations and customer interactions.

- Define Clear Goals: Before installation,outlining what you want the mobile POS system to achieve. This could include streamlining checkouts, improving inventory management, or enhancing customer service. Setting clear priorities helps you focus on features directly supporting your business operations.

- Choose Compatible Hardware and Software: Select hardware that fits your business environment, such as portable devices for mobility or durable models for heavy use. The software should handle your transaction volume smoothly and integrate easily into daily workflows. User-friendly systems also make it easier for staff to adapt.

- Support Local Payment Preferences: A mobile POS in South Africa should work well with popular local payment options, such as SnapScan, Zapper, and various e-wallets. Supporting preferred payment types allows for smoother transactions and encourages customer satisfaction by providing familiar and trusted payment options.

- Enable Real-Time Inventory Tracking: A strong mobile POS system provides more than payment functionality. It should also keep inventory data current across all sales channels. Real-time updates help avoid stock shortages or overstocking, making it easier to respond to changing demand and maintain smooth supply chain management.

- Invest in Staff Training: A new POS setup can be challenging without adequate preparation. Organize training sessions that focus on key tasks, such as processing refunds, resolving common technical issues, and generating reports. A well-trained team operates with greater efficiency and confidence.

- Prioritize Security and Compliance: Since POS systems handle sensitive information, focusing on security is crucial. Choose software with strong encryption and card data protection to meet South Africa’s data protection standards, such as POPIA. Security protocols protect against data breaches, ensuring customer trust and legal compliance.

- Start with a Pilot Program: Testing the mobile POS on a smaller scale before a full rollout can reveal potential operational or technical issues. A pilot phase lets you gather feedback from staff and customers, allowing for adjustments before the system is fully deployed. This approach minimizes risk and helps ensure the setup aligns well with business operations.

- Schedule Regular Maintenance and Updates: Perform routine maintenance to keep the system running efficiently. Periodic updates improve performance, address any software bugs, and maintain compatibility with other tools in your business. Staying proactive in this area reduces downtime and prolongs the life of your system.

- Monitor Performance and Gather Customer Feedback: Tracking performance metrics such as transaction speed, accuracy, and overall usage can highlight areas where the system may need fine-tuning. Additionally, gathering customer feedback provides insight into the checkout experience, which can guide further improvements.

- Plan for Scalability: As your business grows, a scalable POS system will allow for expansion without disruptions. Choose a system that can accommodate a rise in transaction volume, new store locations, or additional staff, thus avoiding costly upgrades or replacements.

ConnectPOS – Mobile POS for South Africa’s Businesses

Weaving flexibility into your business with our mobile POS in South Africa, ConnectPOS offers a seamless and efficient solution designed to meet the unique needs of South African businesses.

- Next-Level Payment Experience: Offer ultimate convenience with flexible payments anywhere, ensuring a smooth and secure transaction experience. ConnectPOS supports multiple payment methods, giving your customers the flexibility they expect.

- Fast-Track Your Checkout: Complete control from anywhere with management on the go. Access and manage your POS South Africa in real-time from any location, ensuring operational continuity and flexibility. This feature is perfect for busy business owners who need to stay connected.

- Personalized Promotions and Discounts: Use customer purchase history to offer personalized promotions and discounts directly at the point of sale. This not only enhances the shopping experience but also boosts customer loyalty.

- Enjoy Customization at Your Fingertips: Design your POS interface with custom layouts, themes, and features that reflect your brand and enhance user interaction. An intuitive customer profile management system allows instant access to and creation of customer profiles, ensuring no important details are missed.

- Comprehensive Reporting: Manage staff, monitor sales, and analyze store performance remotely, enabling data-driven management anytime, anywhere. This empowers you to make informed decisions that enhance your business’s efficiency and profitability.

- Unlock Optimal Performance with Our Integration Network: Our POS software simplifies integration with critical business tools such as leading CRMs, payment gateways, ERP systems, and marketplaces. These strategic integrations provide the flexibility and tools to enhance customer interactions and streamline operations, ensuring your business thrives in any setting.

- Smooth Scaling: Our mobile POS system grows with you, handling increased transactions and multi-location management effortlessly. Whether you’re expanding your business or increasing your transaction volume, ConnectPOS ensures smooth operations without any hitches.

FAQs Mobile POS South Africa

- What are the benefits of using a mobile POS South Africa ?

Mobile POS systems provide flexibility, allowing sales transactions anywhere within or outside a store. This flexibility is especially useful for businesses with mobile or pop-up setups. Additionally, a mobile POS can increase efficiency with faster checkouts and real-time inventory updates, and it supports modern payment methods, which is convenient for customers.

- How much is mobile POS cost in South Africa?

Costs vary depending on the system, with options ranging from monthly subscription fees to one-time software purchases. The total cost may include hardware, software licensing, payment processing fees, and add-ons such as integrations with accounting or CRM systems.

- Can mobile POS systems help with tax compliance in South Africa?

Many mobile POS systems in South Africa are designed to generate reports that help with VAT calculations and tax reporting. These systems track sales and can produce reports formatted to meet South African tax requirements, making it easier for businesses to stay compliant with SARS (South African Revenue Service).

Conclusion

To make the right choice, it’s important to assess the system’s compatibility with local payment methods, its ability to scale with business growth, and the level of support available. With these key factors, businesses can select a mobile POS South Africa solution that solves immediate operational challenges and supports long-term success. Taking the time to make an informed decision will help businesses stay competitive and provide a better customer experience in today’s fast-changing market.

For businesses looking for a reliable, easy-to-use mobile POS system that seamlessly integrates with local payment methods and offers excellent scalability and support, ConnectPOS is the solution. Discover how ConnectPOS can transform your business operations and enhance customer satisfaction by connecting with us today.