A smooth checkout process is vital for enhancing customer experiences. Mobile Point of Sale (POS) systems have revolutionized this area, significantly enhancing how mobile POS helps retail businesses streamline their operations and increase customer satisfaction. These systems not only reduce long queues but also provide personalized service, offering retailers the essential tools to cut through checkout chaos and create seamless shopping experiences.

How Mobile POS Helps Retail Transform Checkout

Mobile POS is not a new technology, but its importance has grown significantly with the increased focus on customer experience.

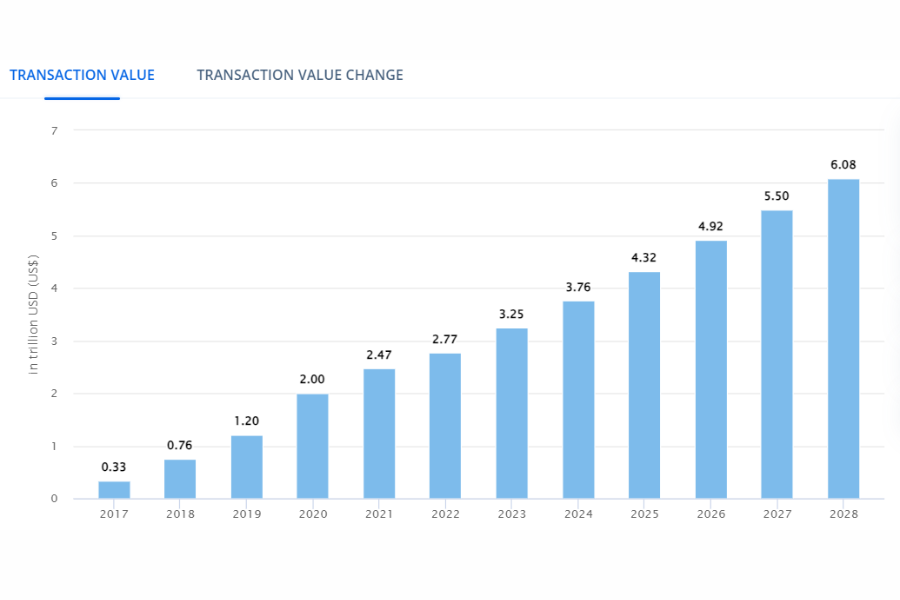

The transaction value in the Mobile POS Payments market is projected to reach $3.76 trillion in 2024. With an expected annual growth rate (CAGR) of 12.77% from 2024 to 2028, the total transaction value is anticipated to reach $6.08 trillion by 2028. Additionally, the number of users in the Mobile POS Payments market is projected to reach 1.99 billion by 2028.

This surge in mobile POS adoption is driven by its ability to transform retail stores in several key ways:

In-Aisle Customer Engagement

- Saving the Sale

Traditional point-of-sale systems engage customers only at fixed terminals, often missing opportunities to recover abandoned sales. Mobile POS systems enable associates to interact with customers at the decision-making point, potentially saving lost sales by locating desired items in other stores or online and ordering them on the spot.

- Cross-Selling and Upselling

Associates equipped with mobile POS devices can assist customers directly in the aisles, providing tailored advice on complementary products or more profitable alternatives, thereby enhancing sales opportunities.

- Queue Busting

Long lines are a major deterrent for shoppers. Studies show that 86% of customers have left a store without purchasing due to long queues, and 70% are less likely to return after experiencing a long wait. Mobile POS allows associates to complete transactions anywhere in the store, significantly reducing queue times and improving overall customer satisfaction.

Transforming Store Layout

- Reducing Fixed Checkouts

By adopting mobile POS, retailers can optimize their floor space by minimizing the number of traditional checkout counters, thus freeing up space for additional merchandising or customer experiences.

- Flexibility

The need for checkout stations can vary, especially during peak times such as holidays or sales events. Mobile POS systems provide the flexibility to quickly adjust the number of active point-of-sale stations as needed, accommodating fluctuating customer volumes without additional permanent fixtures.

Extending Beyond the Four Walls

- Curbside Pickup

Mobile POS enhances omnichannel strategies by enabling online shoppers to pick up their purchases curbside without entering the store, effectively setting up collection stations in parking lots.

- Pop-Up Stores

Ideal for temporary retail setups like pop-up stores, mobile POS systems facilitate rapid setup and minimal counter space. These stores, often used to build brand awareness or test new markets, benefit immensely from mobile POS’s agility.

How Mobile POS Helps Retail with Secure Transactions

Mobile POS systems employ a comprehensive array of security features to ensure secure transactions:

Encryption

- End-to-End Encryption (E2EE)

Mobile POS systems employ end-to-end encryption to protect data from the moment a transaction is initiated until it is securely processed by the payment gateway. This level of encryption ensures that sensitive data, such as credit card details, are never exposed during transit.

- Secure Sockets Layer (SSL) and Transport Layer Security (TLS)

Mobile POS systems employ end-to-end encryption to protect data from the moment a transaction is initiated until it is securely processed by the payment gateway. This level of encryption ensures that sensitive data, such as credit card details, are never exposed during transit.

Tokenization

- Dynamic Tokens

Tokenization replaces sensitive card information with randomly generated tokens that are unique to each transaction. These tokens cannot be decrypted without the corresponding decryption key held by the payment processor, which significantly enhances security.

- Reduced PCI Scope

By minimizing the storage of sensitive data on local systems, mobile POS systems help reduce the scope and complexity of PCI DSS compliance, lowering both risk and cost.

Europay, Mastercard, and Visa (EMV) Chips:

- Dynamic Data Authentication (DDA)

EMV chips generate unique transaction codes that are verified by the issuing bank. This prevents the reuse of transaction details and reduces the risk of card-present fraud.

- Chip-and-PIN vs. Chip-and-Signature

Transactions requiring a PIN (chip-and-pin) provide an additional layer of security compared to those that only require a signature (chip-and-signature), which can be more easily forged.

Secure Software and Hardware

- Certified Devices

All hardware and software used in mobile POS systems meet rigorous industry standards, such as PCI PTS for hardware and PCI DSS for software, ensuring comprehensive security compliance.

- Regular Updates and Patches

To protect against emerging threats, mobile POS vendors regularly update their systems to patch vulnerabilities and enhance security features.

Multi-Factor Authentication (MFA)

Access to mobile POS systems typically requires multi-factor authentication, which may include passwords, biometric data (e.g., fingerprints, facial recognition), or one-time codes sent to a mobile device. This significantly reduces the risk of unauthorized access.

By integrating these advanced security technologies, mobile POS systems provide a robust framework to protect against data breaches, fraud, and unauthorized access, ensuring safe and secure transactions for both merchants and customers.

How ConnectPOS Mobile POS Helps Retail Businesses In the Checkout Process

ConnectPOS Mobile POS offers essential flexibility to streamline checkout processes and enhance customer experiences.

Our system seamlessly scales with your business, managing increased transactions and multi-location operations effortlessly. With flexible integration options, you can customize and expand your POS capabilities to meet evolving needs.

Essential flexibility in the checkout process

ConnectPOS offers unparalleled flexibility in the checkout process, crucial for growing retail businesses.

The system smoothly scales to accommodate business expansion, managing increased transactions and extending across multiple locations effortlessly. The architecture is designed for easy modification and expansion, allowing for flexible integration with other systems.

Additionally, the Express Checkout feature significantly streamlines payments, reducing queues and improving the in-store experience for customers, ensuring transactions are swift and efficient.

Complete Control From Anywhere

With ConnectPOS, retailers gain complete control over their operations from any location.

The system allows for real-time access and management, providing operational flexibility essential for modern retail. It includes integrated mobile inventory tracking that supports efficient item transfers across locations, optimizes stock levels, and reduces waste while managing suppliers and returns effectively.

Moreover, comprehensive mobile reporting capabilities enable remote monitoring of staff, sales, and store performance, facilitating data-driven decisions from anywhere, at any time.

Skip the Wait for Your Customers

ConnectPOS enhances the checkout experience by offering next-level payment options that provide flexibility and security for smooth transactions.

Customer service capabilities are extended directly to the sales floor, where staff can deliver quick checkouts and instant assistance, ensuring a seamless customer experience.

Additionally, the system leverages customer purchase history to offer personalized promotions and discounts at the point of sale, further enhancing customer satisfaction and loyalty.

Enjoy Customization at Your Fingertips

ConnectPOS is highly customizable, allowing retailers to design their POS interface with custom layouts, themes, and features that best reflect their brand and enhance user interaction.

It facilitates the intuitive management of customer profiles directly on the mobile POS, ensuring that no important customer details are overlooked. Retailers can also adapt the checkout process to meet unique business needs and customer demands, ensuring a consistently smooth shopping experience.

Unlock Optimal Performance with Integration

ConnectPOS simplifies the integration of essential business tools such as leading CRMs, payment gateways, ERP systems, and marketplaces.

These strategic integrations not only enhance customer interactions but also streamline operations, providing the necessary tools to ensure that the business thrives in any retail setting. By leveraging these integrations, ConnectPOS empowers retailers to maximize efficiency and performance across all aspects of their business operations.

FAQs: How Mobile POS Helps Retail Businesses

- What types of payments can mPOS systems accept?

Mobile POS systems accept a variety of payment methods, including credit and debit cards (magnetic stripe and EMV chip), contactless payments (Apple Pay, Google Pay, Samsung Pay), mobile wallets, cash, and gift cards. They can also integrate with loyalty programs.

- Is an mPOS system suitable for all types of businesses?

Yes, mPOS systems are suitable for various businesses, including retail stores, restaurants, service providers, pop-up shops, markets, and delivery services. They enhance customer experience, streamline operations, and offer flexibility.

- Can mPOS systems work offline?

Many mPOS systems can work offline, allowing transactions to be processed and stored securely until internet connectivity is restored. Once reconnected, transactions are automatically synced and processed.

- How does mobile POS help retail ensure secure mPOS transactions?

mPOS transactions are highly secure. They use end-to-end encryption, tokenization, and EMV chip technology to protect data. mPOS systems comply with industry standards like PCI DSS, receive regular updates for enhanced security, and often feature multi-factor authentication for added protection.

- What are the hardware requirements for a Mobile POS system?

The hardware requirements for a Mobile POS system typically include a tablet or smartphone, a card reader for processing payments, and optional peripherals such as a barcode scanner, receipt printer, and cash drawer. Some systems may also require an internet connection.

Conclusion

The way how mobile POS helps retail has revolutionized the way retail businesses manage their checkout processes. By offering flexibility, speed, and personalized service, these solutions empower retailers to navigate the challenges of modern commerce effectively. As the retail landscape continues to evolve, mobile POS will remain a vital tool for businesses looking to stay ahead and deliver exceptional customer experiences.

Feel free to contact us for further details about ConnectPOS and how it can accelerate your sales!

ConnectPOS is a all-in-one point of sale solution tailored to meet your eCommerce POS needs, streamline business operations, boost sales, and enhance customer experience in diverse industries. We offer custom POS with features, pricing, and plans to suit your unique business requirements.