The vibrant South African retail scene is seeing significant changes underway, with the evolution of modern tech such as next-gen point of sale systens. This blog examines the evolving retail landscape in South Africa and offers expert tips for selecting the ideal Point of sale devices for businesses in the region.

Highlights

- The South Africa POS Terminal Market is projected to grow at a CAGR of 9.9% from 2022 to 2028.

- Mobile POS, self-service and cloud-based systems are gaining popularity in the South African market.

- The most efficient tips for selecting the right POS systems are: assessing business needs; opting for POS with e-commerce integration; and mobile POS/ contactless payment.

Understanding The Market of Point of Sale Devices South Africa

The retail market of point of sale devices South Africa is evolving with advanced technologies like cloud computing and mobile device systems.

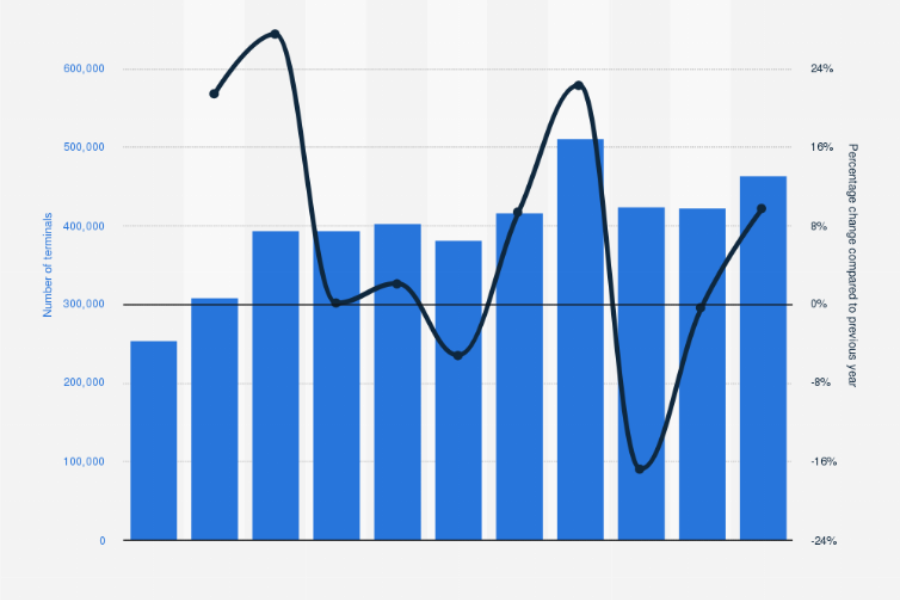

Retailers adopt modern POS device solutions for better transaction efficiency, security, and customer service. Customizable and scalable POS solutions are now offered to meet the needs of various retailers. The market is projected to grow at a CAGR of 9.9% from 2022 to 2028, and a nearly 10% increase in POS devices between 2021 and 2022.

Key drivers include the shift to cashless transactions, POS integration with CRM and inventory management, and the rise of e-commerce and mobile commerce. Challenges are high costs for small businesses, integration expenses, cybersecurity threats, lack of rural infrastructure, and economic fluctuations.

Government policies promoting financial inclusion and digital payment systems impact the POS market. The South African Reserve Bank and National Treasury have implemented policies to expand access to electronic payment systems, encouraging modern POS adoption. Regulations under the Financial Intelligence Centre Act (FICA) ensure compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) requirements, enhancing transaction security.

Types of Point of Sale Devices

Traditional POS Systems

Traditional POS systems are stationary setups commonly used in larger retail environments. These systems typically include hardware components such as cash drawers, barcode scanners, receipt printers, and monitors. They are well-suited for businesses with high transaction volumes and require robust hardware integration.

Mobile POS systems are designed for portability and can be operated on smartphones and tablets. These systems are ideal for businesses that need flexibility, such as restaurants, pop-up shops, and small retail stores. Mobile POS systems allow sales staff to process transactions anywhere within the store, improving customer service and reducing checkout lines.

Cloud-Based POS Systems

Cloud-based POS systems store data online, allowing for real-time updates and access from multiple locations. This type of system is perfect for businesses with multiple outlets or those looking for centralized management of their operations. Cloud-based systems offer the advantage of automatic updates, remote access, and easy scalability.

Self-Service Kiosks

Self-service kiosks are gaining popularity in industries like fast food and retail. These kiosks allow customers to place orders or check out independently, reducing the need for staff intervention and speeding up the transaction process. Self-service kiosks enhance the customer experience by providing a quick and convenient way to make purchases.

Integrated POS Systems

Integrated POS systems combine the functionalities of a POS system with other business operations such as inventory management, customer relationship management (CRM), and accounting. These systems provide a comprehensive solution for businesses looking to streamline operations and improve efficiency. Integrated POS systems are suitable for businesses that require a unified platform to manage various aspects of their operations.

Tips for Choosing the Right Point of Sale Device for South Africa Businesses

Selecting the ideal point of sale devices South Africa for your business is the integrable step for efficient operations and enhanced customer experience. In South Africa, where diverse business environments and technological needs exist, we’ve listed down key considerations to ensure you make the right choice:

Assess Your Business Needs

- Type of Business: Determine whether you need a point of sale devices South Africa for retail, hospitality, or service industries. For example, restaurants might benefit from POS systems with table management features, while retail stores might need robust inventory tracking.

- Volume of Transactions: For high-traffic businesses, such as supermarkets, invest in high-speed, durable POS systems. For smaller businesses, a compact, cost-effective solution might be sufficient.

Consider Mobile POS Solutions

- Flexibility: In South Africa, the transaction value in the Mobile POS Payments market is projected to hit $5.46 billion in 2024. That proves Mobile POS systems are necessary for this market, and provide the flexibility to process transactions both within your store and off-site. This capability is especially beneficial for businesses with outdoor or mobile setups.

- Integration: Ensure the mobile POS can integrate with your existing systems, such as inventory and customer relationship management (CRM) tools.

Opt for Cloud-Based Systems

- Real-Time Data Access: Cloud-based POS systems allow you to access sales data, inventory levels, and customer information from anywhere with an internet connection. This is particularly useful for managing multiple locations or remote operations.

- Automatic Updates: Benefit from automatic updates and backups without the need for manual intervention, ensuring you always have the latest features and security patches.

Support Contactless Payments

- NFC Technology: With the rise of contactless payments, choose a point of sale devices South Africa that supports NFC (Near Field Communication) to accept tap-and-go transactions. This speeds up the checkout process and meets customer preferences for contactless payments.

- Compliance: Ensure the POS system adheres to local and international payment security standards, such as PCI-DSS, to safeguard transaction data.

Integration with E-Commerce Platforms

- Seamless Synchronization: For businesses with online stores, ensure the POS system integrates seamlessly with your e-commerce platform. This synchronization helps manage inventory, process orders, and track sales across both online and offline channels.

- Unified Reporting: Access consolidated reports that combine online and offline sales data, providing a comprehensive view of your business performance.

Evaluate Inventory Management Capabilities

- Real-Time Tracking: Opt for a POS system that offers real-time inventory tracking, automatic reordering, and alerts for low stock levels. This ensures you maintain optimal inventory levels and reduce stockouts.

- Supplier Integration: Integration with suppliers can streamline order placements and manage stock more efficiently.

Ensure Robust Customer Support and Training

- Support Availability: Choose a provider of point of sale devices South Africa that offers reliable customer support to address technical issues and provide assistance when needed. Look for options with 24/7 support or a responsive local team.

- Training Resources: Ensure the provider offers comprehensive training for your staff, including tutorials and documentation to help them quickly adapt to the new system.

Check for Regulatory Compliance

- Data Protection: Ensure the POS system complies with South African data protection regulations, such as the Protection of Personal Information Act (POPIA). This is crucial for safeguarding customer data and avoiding legal issues.

- Financial Standards: Verify that the POS system adheres to local financial transaction standards and supports necessary tax calculations and reporting.

Cost and Budget

- Initial Investment: Consider both the upfront costs of the POS hardware and software, including any additional fees for setup and installation.

- Ongoing Costs: Evaluate ongoing costs such as subscription fees, transaction fees, and maintenance charges. Ensure that the total cost of ownership fits within your budget.

- Value for Money: Weigh the features and benefits of the POS system against its cost to ensure you are getting good value for your investment.

By carefully evaluating these factors, you can select a point of sale devices South Africa that meets your business needs, enhances operational efficiency, and improves the overall customer experience in South Africa.

Why should you choose ConnectPOS in choosing Point Of Sale devices in South Africa

ConnectPOS is an excellent choice for South African businesses seeking a robust and versatile point of sale devices South Africa. Here’s why ConnectPOS stands out:

Comprehensive Integration

ConnectPOS integrates effortlessly with leading payment platforms like Flutterwave and Paystack, ensuring quick and secure transactions. This versatility supports a wide range of payment methods, catering to diverse customer preferences.

Moreover, our system integrates smoothly with existing CRM, IMS, and OMS, providing real-time data updates. This is particularly useful for businesses operating across multiple eCommerce platforms or using various third-party software.

Flexibility and Customization

ConnectPOS also supports a variety of payment methods, allowing South African retailers to tailor the system to local payment preferences and customer needs.

The PWA from our system offers features like self-checkout, offline payment capabilities, and remote synchronization, ensuring a consistent and personalized experience across all sales channels.

Mobile and Versatile Solutions

We offer Mobile POS that operates on tablets and smartphones, enabling businesses to process transactions anywhere—whether inside the store or off-site. This is ideal for businesses with outdoor or mobile setups.

Advanced Security Features

ConnectPOS incorporates advanced security measures and partners with well-known payment gateways to protect transaction data. This commitment to security provides peace of mind for both retailers and customers, making it a reliable choice among point of sale devices in South Africa.

Cost-Effective and Efficient

By operating on common devices like tablets and smartphones, ConnectPOS helps reduce hardware investment and maintenance costs. This makes it a cost-effective solution for businesses of all sizes.

In summary, ConnectPOS offers a combination of seamless integration, flexibility, mobility, and advanced security, making it a premier choice for South African retailers looking to enhance their POS systems and improve operational efficiency.

FAQs About Point Of Sale Devices South Africa

1. What types of POS devices are available in South Africa?

In South Africa, you can find:

- Traditional POS Terminals: Fixed systems used at checkout counters.

- Mobile POS (mPOS) Systems: Portable devices like tablets or smartphones that can process transactions anywhere.

- Cloud-Based POS Systems: Systems that store data online, offering remote access and integration with other business tools.

2. What are the prospects for the market of point of sale devices South Africa?

The future looks promising, with continued growth driven by technological advancements, increased digital payment adoption, and a shift towards more integrated and flexible POS solutions. Businesses can expect further innovations and enhancements in POS technology to meet evolving consumer and operational needs.

3. How do South African businesses benefit from integrating POS systems with e-commerce platforms?

Integration with e-commerce platforms helps South African businesses synchronize online and offline sales, manage inventory across channels, and provide a seamless customer experience. It also aids in streamlining operations and improving data accuracy.

Conclusion

As the retail landscape in South Africa continues to evolve, selecting the right point of sale devices South Africa is crucial for businesses looking to stay ahead. With advancements in technology and increasing consumer expectations, choosing a POS system that offers flexibility, seamless integration, and robust features is essential.

ConnectPOS stands out as a top choice for South African businesses, offering a versatile, user-friendly, and secure solution tailored to meet local needs. Ready to elevate your business with our advanced POS system? Contact us today to learn more and get started!

ConnectPOS is a all-in-one point of sale solution tailored to meet your eCommerce POS needs, streamline business operations, boost sales, and enhance customer experience in diverse industries. We offer custom POS with features, pricing, and plans to suit your unique business requirements.