By now, you’re likely familiar with the benefits of integrating a POS Integration with ecommerce platform. For most modern businesses, this integration enables seamless sales, inventory, and customer data management across online and offline channels. It’s the backbone of efficient operations, ensuring accurate data syncing and streamlined processes. However, POS integration can involve hidden costs, setup complexities, and varying feature offerings depending on the provider. How can you reduce operational costs without compromising on essential features? Let’s explore key tips for cost-efficient POS integration with your ecommerce platform.

Highlights:

- Integrating a POS with an e-commerce platform often involves upfront investment in software, hardware, and customization, alongside ongoing expenses like system updates and technical support.

- Choose scalable solutions, prioritize essential features, and leverage cloud-based platforms to reduce infrastructure costs while maintaining seamless integration.

Identifying Cost-Intensive Areas in POS Integration with Ecommerce for Business Operations

Integrating POS systems with ecommerce can lead to several cost-intensive areas that businesses need to consider. Understanding these factors helps in managing expenses effectively.

- Hardware Costs: The cost of POS hardware varies widely, from basic devices like card readers ($20–$50) to more advanced systems such as digital menu boards ($200–$2,000). As businesses expand, additional hardware such as barcode scanners, receipt printers, or mobile payment systems may be required, further increasing costs.

- Software Subscription and Licensing: POS software pricing ranges from $10 to $250 per month, depending on the system’s capabilities and type (cloud-based, on-premise, or hybrid). Long-term software costs can add up, especially with regular updates, maintenance, and support services. Businesses need to budget for both initial software licenses and recurring fees.

- ecommerce Integration Fees: For businesses operating both physical and online stores, syncing sales data across platforms is essential. Standalone POS systems may require additional integration software, adding setup and maintenance costs. Some POS systems offer built-in ecommerce integration, reducing these expenses.

- Transaction and Processing Fees: Transaction fees based on the volume of sales processed can accumulate over time. These fees, usually a percentage of each sale, become a substantial cost for businesses with high sales volumes. Businesses should compare different providers’ rates to find the most cost-effective option.

- Support and Maintenance: After the initial setup, support and maintenance fees can quickly add up. Many POS providers charge for ongoing support or require payment for updates beyond the warranty period. It’s essential to consider these costs when selecting a provider and integrating with ecommerce.

- Custom Features and Add-Ons: As businesses grow, they often require additional features such as inventory management, customer loyalty programs, or advanced analytics. Customizations and integrations with other software solutions can increase both the upfront and ongoing costs of a POS system.

- Installation and Setup Fees: Initial installation, configuration, and staff training costs should be factored in, especially for complex POS and ecommerce integrations. Depending on the complexity, these fees can be a significant expense during the transition phase.

Understanding and planning for these cost-intensive areas ensures that businesses can manage their budgets effectively and make informed decisions when integrating POS with ecommerce systems.

Tips to Lower Operational Costs in POS Integration with Ecommerce

Automate Inventory Management

Automating inventory systems provides real-time data on stock levels, eliminating the need for manual inventory checks and reducing human error. This leads to more accurate stock levels and better decision-making, which minimizes the risk of stockouts or overstocking. Both situations can be costly – stockouts lead to lost sales and customer dissatisfaction, while overstocking results in excess inventory storage fees and potential product obsolescence.

Automation also allows for better demand forecasting. Advanced systems can analyze historical sales data and market trends to predict future demand. This ensures that inventory levels are aligned with actual customer needs, minimizing holding costs and optimizing stock turnover rates. Automated reordering also ensures that stock is replenished at optimal times, avoiding delays or the need for rush orders, which can incur higher shipping and operational costs.

Moreover, integrated inventory management systems of POS Integration with ecommerce improve synchronization across sales channels. Whether customers are shopping in-store or online, the system provides an up-to-date view of stock availability, preventing overselling and ensuring a smooth customer experience.

Improve Payment Processing Efficiency

Payment processing is a fundamental aspect of any retail operation, whether online or in-store. According to a report by the National Retail Federation (NRF), merchants can pay anywhere from 2% to 3% per transaction in credit card fees alone. By centralizing payment processing across both POS and ecommerce systems, businesses can reduce transaction fees, streamline reconciliation processes, and enhance cash flow.

A unified payment system eliminates the need for separate contracts with multiple payment processors, which often results in hidden fees and higher operational costs.

Furthermore, integrating tokenization and encryption technologies not only protects sensitive payment data but also reduces compliance costs associated with PCI-DSS standards. The cost of PCI-DSS compliance for mid-sized retailers can range from $10,000 to $50,000 annually, depending on the volume of transactions.

Tokenization, which substitutes sensitive data with secure tokens, helps lower the risk of data breaches and reduces the cost of compliance by minimizing the amount of sensitive data stored. Additionally, automating payment reconciliation can save businesses up to 40% in manual reconciliation costs, improving financial transparency and reducing administrative workload.

►►► Optimal solution set for businesses: Multi store POS, Next-gen POS, Inventory Management Software (MSI), Self Service, Automation, Backorders

Centralize Customer Data Management

Centralizing customer data across POS Integration with ecommerce is vital for operational efficiency and cost control. A McKinsey report highlights that businesses with integrated customer data across all touchpoints can increase customer satisfaction by up to 20%, leading to greater retention and repeat business.

Maintaining disparate customer databases across systems introduces redundancy, errors, and increased maintenance costs. By consolidating data in a single, unified platform, businesses can lower the operational costs associated with data duplication, inconsistent records, and manual updates.

Data quality management tools, such as automated data validation and cleansing, can also cut down on costly errors. According to IBM’s study on data quality, poor data quality can cost businesses an average of $9.7 million per year in lost revenue and increased operational inefficiencies. By using centralized, automated tools, businesses can prevent these errors and reduce the need for labor-intensive data management processes.

Additionally, having all customer information in one place opens the door for advanced customer segmentation. With more accurate customer profiles, businesses can implement targeted marketing campaigns that drive higher ROI on their marketing spend, lowering customer acquisition costs. Salesforce reports that personalized marketing efforts result in a 20% increase in sales, showing that better customer data leads to more effective, cost-efficient marketing strategies.

Leverage Reporting and Analytics

Advanced reporting and analytics of POS integration with ecommerce drive cost reduction by providing deeper insights into sales trends, customer behaviors, and operational inefficiencies. A Gartner study found that businesses with advanced analytics improve profitability by up to 25%. Analytics help identify resource waste, such as overstocking or understocking inventory, enabling adjustments that reduce storage costs and optimize cash flow.

Predictive analytics is another game-changer for businesses aiming to reduce costs. By utilizing machine learning algorithms to predict consumer demand, companies can adjust inventory levels more accurately, which in turn reduces excess stock and stockouts.

According to Forrester, businesses that use predictive analytics report a 50% reduction in excess inventory and a 30% reduction in stockouts, translating to significant savings in both warehousing and lost sales opportunities.

Real-time reporting dashboards also provide immediate visibility into operational metrics, allowing businesses to react quickly to emerging trends. This proactive approach reduces the risk of costly disruptions, such as supply chain delays or order processing errors. A Deloitte study found that businesses using real-time reporting tools experienced 40% fewer operational inefficiencies, allowing them to reallocate resources to more profitable areas.

Invest in Scalable and Flexible Solutions

Adopting cloud-based systems is another powerful way to reduce operational costs. Cloud solutions allow businesses to scale their POS and ecommerce operations as needed, without the significant upfront investment required for traditional on-premise systems.

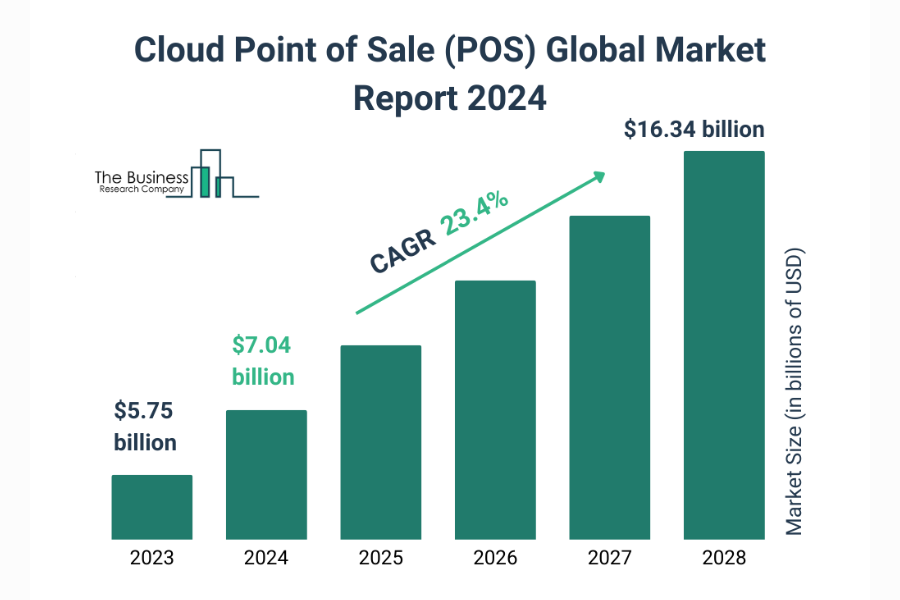

The global cloud POS market is expected to grow from $5.75 billion in 2023 to $16.38 billion by 2028, driven by the need for cost-effective and scalable solutions. Cloud-based platforms offer lower upfront costs, pay-as-you-go pricing models, and the ability to scale up or down based on demand fluctuations, which makes them an attractive option for businesses looking to reduce capital expenditures.

In addition, cloud-based systems often come with built-in redundancy and automatic software updates, reducing the need for dedicated IT infrastructure and ongoing maintenance. By transitioning to cloud-based solutions, businesses can reduce IT overhead by as much as 30%, as reported by CIO Magazine.

API-driven platforms also provide flexibility in integrating new technologies and business tools as they emerge. Businesses can avoid large-scale system overhauls, reducing the risk of downtime and lost revenue during system transitions. Accenture estimates that businesses that use modular and API-based systems reduce integration costs by up to 40%, thanks to the ease of incorporating third-party services and tools.

How ConnectPOS Minimizes Operational Costs of POS Integration with Ecommerce

ConnectPOS minimizes operational costs in POS integration with ecommerce through several features that simplify processes and improve efficiency.

- Unified Platform for POS and ecommerce: A unified platform combines in-store and online operations, eliminating the need for separate systems. This cuts integration costs and administrative overhead while maintaining consistency across sales, inventory, and customer data.

- Real-Time Inventory Sync: Real-time inventory synchronization between POS and ecommerce ensures stock levels remain accurate, preventing stockouts and overstocking. This reduces inventory management costs and the need for manual stock tracking, saving labor expenses.

- Automated Order Management: This improves order processing by syncing orders from both channels, minimizing manual input and reducing errors. This leads to faster order fulfillment, lower labor costs, and reduced chances of operational delays.

- Centralized Customer Data: Centralizing customer data across POS and ecommerce platforms prevents discrepancies and simplifies customer relationship management. It improves marketing effectiveness and customer retention without additional resources, further cutting operational costs.

- Cloud-Based Solution: As a cloud-based solution, ConnectPOS eliminates the need for on-site infrastructure, lowering costs tied to hardware maintenance, storage, and IT support. Cloud capabilities also allow businesses to scale as needed, avoiding overspending on unused resources.

- Cross-Channel Sales Reporting: Consolidated sales reporting across channels provides valuable insights, which help in making informed decisions about product inventory and customer preferences. This reduces waste and minimizes inventory costs.

- Mobile POS Capabilities: Mobile POS functionality allows staff to assist customers throughout the store, making better use of space and reducing the need for additional checkout stations. This lowers infrastructure costs while improving customer experience and sales efficiency.

- Integrated Payment Solutions: Integration with various payment processors ensures smoother transactions without the need for multiple payment systems. The simplified process cuts down on payment-related overhead and avoids extra integration fees.

ConnectPOS supports a more streamlined and cost-effective operation by combining automation, cloud functionality, centralized data management, and cross-channel reporting. This helps businesses manage resources more effectively while cutting down on operational costs.

FAQs: POS Integration with Ecommerce

- How does automated order management lower costs?

Automated order management reduces manual work by syncing orders from both POS and ecommerce platforms. This decreases the chances of errors and delays, leading to faster order processing and a reduction in labor costs.

- Can centralized customer data in POS integration with ecommerce help cut costs?

Centralized customer data allows businesses to manage customer relationships more effectively, avoiding errors that can lead to additional resource costs. It also helps improve targeted marketing, reducing unnecessary spending on broad campaigns. - What are the financial benefits of using a cloud-based POS system?

A cloud-based POS system removes the need for costly on-premise infrastructure, such as servers and IT maintenance. Businesses pay for only the resources they use, which lowers overhead costs and offers flexibility for growth.

Conclusion

Reducing operational costs from POS integration with ecommerce starts with understanding your business needs and evaluating the options available. A thoughtful approach can simplify your operations and help you avoid unnecessary expenses.

If you’re looking for a dependable partner with clear pricing and robust functionality, ConnectPOS is here to help – contact us today to learn more.

►►► Optimal solution set for businesses: Shopify POS, Magento POS, BigCommerce POS, WooCommerce POS, NetSuite POS, E-Commerce POS