Considering the costs of a POS for grocery store? Our comprehensive POS cost guide breaks down the financial aspects of software fees, hardware investments, and payment processing. Whether you run a small shop or a large operation, you’ll find detailed cost elements to aid in your decision-making process.

Highlights

- Costs of POS for grocery store are composed of: POS software costs, hardware and payment processing fees.

- Business should consider their needs, size and scalability, and pricing models to choose the right POS system.

Understanding Costs of POS for Grocery Store

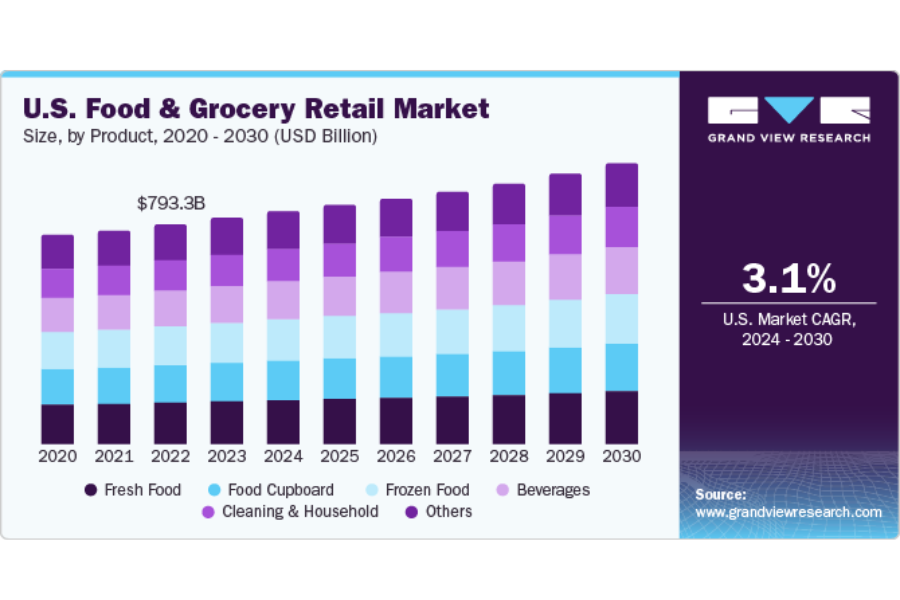

As the global food and grocery retail market is projected to grow at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030, businesses should adopt POS systems to leverage the benefits they offer.

However, they must carefully assess the associated costs, including POS software — which forms the backbone of the system and dictates its core functionalities — POS hardware and payment processing fees.

- POS Software Costs: Monthly costs for POS software can range from a modest $15 to over $100, primarily influenced by the complexity of the features and the size of the business.

- POS Hardware Costs: Hardware investments are the tangible aspect of your POS system. This may include tablet-based systems, full countertop setups, or mobile card readers, with costs ranging from $300 to $2,500.

- Payment Processing Fees: Payment processing fees are a critical component of the overall POS system costs, varying based on the provider and transaction volume.

Understanding these costs involves not just calculating the initial investment but also assessing the ongoing operating costs, including processing fees, for a comprehensive view of the total POS system investment.

Evaluating POS Software Options

Free POS Software

Free options have carved out a niche in the realm of POS software. Independent retailers may have the opportunity to implement a basic retail POS system at no cost, helping streamline their operations and improve customer service. Options like Square and PayPal Zettle, which offer mobile card readers, have made POS systems more affordable for small businesses.

While these free plans can help reduce upfront costs for retail businesses, there’s a catch. They often come with higher transaction fees, which can offset the cost savings from the free software. Therefore, it’s essential to account for these costs when choosing a POS for grocery store.

Paid POS Software

Moving up the pricing ladder, we find paid POS software plans that offer robust features such as:

- Deep inventory management

- Reporting

- Marketing

- Loyalty programs

- E-commerce integration

These elements are indispensable for restaurant operations and other complex business needs. The costs for these subscriptions can range from $29 to over $300 per month per terminal, scaling up based on the business size and the capabilities needed, including potential upfront licensing fees. However, the investment in these advanced features can pay off.

For instance, sales trend analysis enabled by paid POS for grocery stores can steer businesses toward high-return activities and streamline operations to reduce overall expenses.

Moreover, most POS systems, especially the paid ones, often come without user limitations, allowing unlimited staff to use the point-of-sale system across licensed terminals. This enhances efficiency and operational flexibility.

Hardware Considerations and Expenses for POS in Grocery Stores

After software, the tangible component of your POS for grocery store is the POS hardware. Currently, the POS hardware market is experiencing a transformative phase driven by technological innovations and shifting consumer preferences. It is projected to reach USD 51.6 billion by the end of 2030, with a CAGR of 10.5%. The specific hardware requirements can vary based on your business needs and may include:

- Mobile card readers

- Cash registers

- Barcode scanners

- Receipt printers

The costs for these can range from under $50 to over $2000, depending on what you choose.

- Cash Registers: Entry-level options cost under $200, while high-end options with features like magnetic card readers and touchscreen terminals can exceed $2000.

- Barcode Scanners: Necessary for retail operations, these can cost between $50 to $300 each.

- Card Readers: Priced around $39 to $49.

- Receipt Printers: Fall in the range of $289 to $399.

The complexity of the hardware setup may increase the initial costs of POS for grocery store due to the need for compatible equipment or additional accessories. However, these costs are a worthwhile investment for the long-term efficiency and productivity of your business.

Purchasing vs Leasing Hardware

When it comes to acquiring POS hardware, businesses often face the decision to purchase or lease.

- Leasing:

- Pros: Lower upfront costs, ongoing customer support, and easier technology upgrades.

- Cons: More expensive in the long term due to monthly fees, service charges, and potential interest rates.

- Purchasing:

- Pros: Greater long-term profitability, customization, equipment guarantees, or warranties.

- Cons: Higher initial investment required.

Financing Options for POS Hardware

For businesses not ready to make an outright hardware purchase, financing options offer a respite. They allow businesses to spread their investment over a year or more, easing the financial burden of the initial investment. Some providers even offer free or discounted mobile readers and cash register equipment upon sign-up, along with payment plans for more expensive items.

Navigating Credit Card Processing Fees

Navigating credit card processing fees can be complex. These fees of POS for grocery store are influenced by the merchant services provider, with some providers offering flat rates while others use variable transaction fees based on different payment methods.

Businesses that process a high volume of credit card transactions can often negotiate lower per-transaction rates, especially if they exceed certain thresholds in card payments each month.

The type of transaction also affects these fees. Swiped card transactions generally incur lower processing fees compared to keyed-in transactions due to the lower risk of fraud associated with swiped payments. To secure the most advantageous credit card processing rates, businesses should:

- Become knowledgeable about industry-specific terms

- Understand their transaction patterns

- Choose a pricing structure that aligns with their business model and volume.

Tips for Reducing Costs for POS for Grocery Store

Investing in a POS for grocery store is a crucial decision for grocery stores, but there are effective strategies to manage and reduce these costs. By making informed choices about software, hardware, and payment processing, businesses can optimize their investment and enhance their operational efficiency.

Tips for Reducing POS Costs:

- Choose the Right POS System: Selecting a POS system that aligns with your business needs can prevent unnecessary expenses. Opt for a system with essential features and avoid paying for functionalities you won’t use. A scalable POS solution is advantageous, allowing you to expand and upgrade as your business grows without incurring significant additional costs.

- Consider Free or Low-Cost Software: Explore free POS software options with basic functionalities. These options can be particularly beneficial for small businesses or those starting out. For subscription-based software, ensure you’re only paying for the features you need and avoid overpaying for advanced functionalities that may not be necessary for your current operations.

- Leverage Existing Hardware: Reduce hardware costs by using existing devices such as tablets or smartphones as part of your POS for grocery store. This can minimize the need for new equipment. Additionally, consider refurbished or second-hand hardware for items like cash registers, barcode scanners, and receipt printers, which can offer substantial savings.

- Negotiate with Service Providers: Negotiating with credit card processing providers can lead to lower transaction fees, especially if you handle a high volume of transactions. Providers may offer reduced rates or special deals for businesses that meet certain thresholds. Look for bundled service packages that include hardware, software, and support at a discounted rate.

- Utilize Financing Options: If an upfront investment in POS hardware is challenging, consider leasing or financing options. These allow you to spread costs over time and may include free or discounted hardware upon sign-up, reducing initial expenses.

- Implement a Zero-Fee Credit Card Processing Program: One effective cost-saving strategy is to implement a zero-fee credit card processing program, where transaction costs are passed on to the customer. This approach can help alleviate the burden of processing fees for your business.

- Opt for Annual Software Subscriptions: Choosing annual subscriptions for POS software rather than monthly payments can result in significant savings. Many providers offer discounts for annual plans, making this a cost-effective option over time.

Choosing the Right POS System – Comparing Providers and Costs

Choosing the Right POS System for Your Business

Selecting the right POS for grocery store is essential for optimizing your business operations and achieving growth. This decision involves balancing several critical factors, including features, scalability, pricing models, user-friendliness, and customer support options.

Assess Business Needs and Features

Start by ensuring that the POS system offers the necessary features to support your business operations. These may include inventory management, employee scheduling, and integration with an e-commerce platform, if applicable.

For instance, ConnectPOS offers custom POS with flexible solutions to different business needs, such as the Professional package for seamless omnichannel integration and the Enterprise package for advanced customization and technology.

Consider Business Size and Scalability

Choose a POS system that fits your business size and can scale with your growth. Small retailers may require basic hardware, while larger operations might need more advanced setups. ConnectPOS provides various packages that cater to different business scales, ensuring you have the right tools as your business evolves.

Review Pricing Models

Evaluate the pricing models of different POS systems to find one that fits your budget. Common models include interchange-plus pricing, tiered pricing, and flat-rate pricing. ConnectPOS offers simple, straightforward, and transparent pricing plans with no hidden fees, making it easier to manage costs without unexpected expenses.

User-Friendliness and Support

Opt for a POS system that is easy to use and requires minimal technical support. A user-friendly system can streamline operations and reduce training time for staff. Additionally, verify that the provider offers comprehensive customer support and has a strong market presence. ConnectPOS is known for its reliable customer support and various package options, ensuring you receive the assistance you need.

Invest in Cybersecurity

Ensure that your POS system includes robust cybersecurity measures to protect customer data and prevent breaches. This is crucial for maintaining customer trust and safeguarding sensitive information.

Choosing the right POS system involves careful consideration of your business needs, growth potential, pricing, ease of use, and support options. ConnectPOS stands out with its clear and transparent pricing, scalable solutions, and professional support, making our system a valuable option for businesses seeking both the efficiency and reliability of retail POS systems.

Frequently Asked Questions

1. What is the average cost of a POS for grocery store?

The cost of a grocery store POS system can vary widely based on the system’s features, hardware, and provider. On average, grocery stores can expect to spend between $300 and $2,500 on hardware.

Monthly software subscription fees typically range from $15 to over $100, depending on the complexity and features of the POS system. Initial setup costs, including installation and training, can add to these expenses.

2. How much does POS charge per transaction?

POS systems charge transaction fees that can vary based on the provider and the payment method used. Typically, transaction fees range from 1.5% to 3.5% per credit card transaction. Some providers offer flat-rate pricing, while others use interchange-plus or tiered pricing structures. High-volume businesses may be able to negotiate lower transaction fees.

3. How much are the maintenance fees of POS for a grocery store?

Maintenance fees for a POS system can include hardware upkeep, software updates, and customer support. Hardware maintenance costs can range from $100 to $500 annually, depending on the equipment and service agreements. Software maintenance fees are often included in subscription costs, but additional charges may apply for premium support or extended warranties.

Conclusion

Investing in a modern POS for grocery store provides significant advantages for small to medium-sized grocery stores, including enhanced efficiency, improved customer experiences, and better inventory management. Though the initial and ongoing costs can be substantial, the potential for increased sales and reduced losses makes it a valuable investment.

By thoroughly evaluating your needs, comparing various options, and planning for implementation, grocery store owners can make informed choices that support their business’s long-term success. It’s essential to demo several POS systems before making a decision. To explore ConnectPOS’s solution, reach out to us here.

ConnectPOS is a all-in-one point of sale solution tailored to meet your eCommerce POS needs, streamline business operations, boost sales, and enhance customer experience in diverse industries. We offer custom POS with features, pricing, and plans to suit your unique business requirements.